Seed Investment Opportunity

Quicka Health:

The AI Clinical Copilot for Australian Healthcare

Every AI scribe automates notes. Only Quicka mentors your clinicians, plans treatments, and grows your team.

The Problem

Clinics Are Leaking Revenue Every Day

Three systemic gaps in allied health are costing clinic networks millions in lost revenue, preventable turnover, and compliance exposure.

Revenue Leakage

Clinicians spend 9–13.5 hours per week on documentation and admin — 24–36% of working hours lost to non-clinical tasks. Under 60% of time is spent on direct patient care. A 10-clinician clinic loses A$350K+/year in recoverable revenue.

Talent Retention Crisis

60% of allied health professionals report high stress from admin burden (AHPA), and 80%+ of healthcare workers report burnout overall — with over 3 hours of paperwork spilling into personal time. Each turnover costs ~A$50K to replace.

The Supervision Gap

Clinical supervision costs A$150–$220/hr. Most clinics can only afford monthly sessions — if at all. New graduates and mid-career professionals practice without consistent mentorship, leading to variable treatment quality and clinical isolation.

Sources: AHPA Survey 2021 · Nuance/NHS Documentation Study 2022 · Mental Health Australia Burnout Surveys 2020–22 · AHRI Turnover Report 2024 · Taylor & Francis Clinical Supervision Study (n=1,113)

Market Opportunity

A Massive, Validated Market

Healthia Multi-Site Pilot Results

| Metric | Result |

|---|---|

| Documentation Time | Statistically significant reduction |

| After-Hours Work | Marked decrease |

| Clinical Productivity | +5.8% average increase |

| Clinician Recommendation | 95% would recommend |

| Patient Experience | Enhanced attentiveness & rapport |

Source: Healthia mixed-methods study, University of Sydney

"This is the way of healthcare in the future."— Assoc. Prof. Kerrie Evans, Healthia & University of Sydney

The Solution

Not Just a Scribe — a Clinical Copilot

Quicka Health is a comprehensive platform that augments clinician capabilities across documentation, decision‑making, and professional growth.

Intelligent Documentation

- Real-time transcription with Australian clinical terminology

- Auto-structured SOAP/SOITP notes, referral letters, clinical correspondence

- User-defined templates & writing style learning

- PMS integration (Cliniko, Nookal) with one-click note push

AI Clinical Mentor

- Real-time clinical guidance during consultations

- Socratic pre-consultation case review

- On-demand mentoring & evidence-based second opinions

- Communication coaching from transcripts

Collaborative Learning Networks

- AI-facilitated peer case discussions

- Senior-to-junior mentoring workflows

- Institutional memory that persists beyond staff turnover

- CPD learning integration (planned)

Product Demo

Live Consultation Recording

Real-time transcription with an AI Clinical Support Panel guiding every session

AI analyses the conversation in real-time, surfacing clinical context and differential diagnoses as you talk

Product Demo

Smart Search

Ask any question about a patient's history — AI instantly searches across all past notes, transcripts, and external records

• Flexion: 145° (↑ from 130° at initial)

• Abduction: 130° (↑ from 110°)

• Pain: 5/10 at worst, improved from 6/10

Ask any question about a patient's history — AI searches across all past notes and transcripts instantly, with source citations

Product Demo

AI Note Generation & Review

Structured SOAP notes stream in seconds — review, refine, and approve in one click

Notes streamed in seconds from the transcript — clinician reviews, edits if needed, and approves with one click

Product Demo

Treatment Plan Generation

AI-drafted multi-phase treatment plans with goals, interventions & appointment schedules — PDF-ready for patients

• Achieve 160° active flexion pain-free

• Independent HEP compliance

• Isometric rotator cuff activation

• Education: load management

• Eccentric loading protocol

• Scapular motor control drills

• Graded return-to-serve program

• Self-management strategies

AI generates multi-phase treatment plans from the consultation — complete with goals, interventions, and a full appointment schedule. PDF-ready for patients.

Product Demo

Focus Mode: Rapid Review & Bulk Push

Review a full day's notes in minutes — then push them all to your PMS in one click

A full day of notes — reviewed and pushed to PMS in under 5 minutes

Product Demo

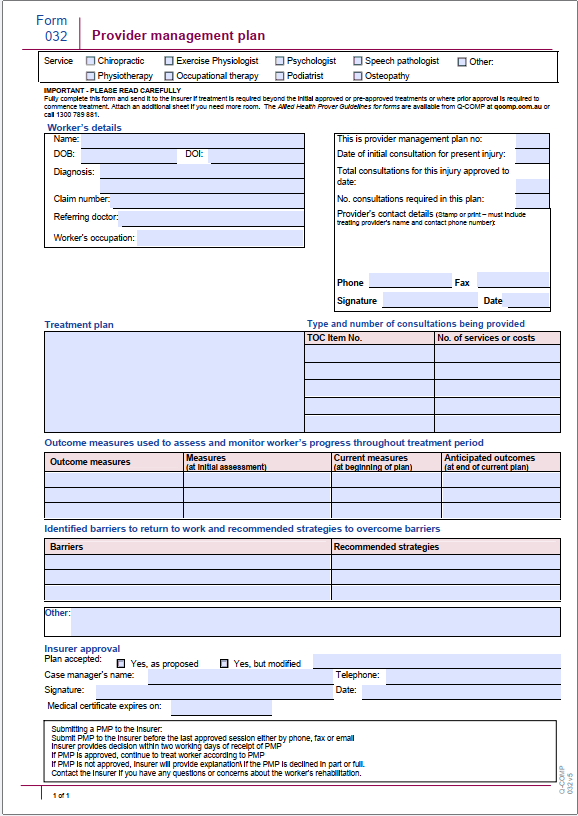

AI Form Filling

Select any form template — AI reads your consultation notes and fills every field in seconds

Dr Sarah Mitchell

Ph: 07 3421 8800

Select a form, AI fills every field from your notes — review and download in seconds

Product Demo

KPI Dashboard & PDF Export

Real-time analytics for clinicians — exportable reports for business owners

Track treatment plan completion, booking rates, and clinician outcomes — export as PDF for management reporting

Product Demo

Communication Coaching

AI analyses your past consultations and surfaces actionable feedback on rapport, education, and conversion

AI analyses your past consultations across rapport, education, conversion, structure, and empathy — with actionable micro-habits to improve

Product Demo

AI Clinical Mentoring

Socratic AI mentor for pre-consultation case review and on-demand clinical guidance

Socratic AI mentor — asks probing questions, never gives the answer outright, and surfaces evidence-based guidance

Product Demo

Team Case Presentations

Collaborative case discussions with AI-facilitated stages and real-time participation

Live collaborative case discussions — AI facilitates each stage and generates coaching feedback for every participant

Product Differentiation

What Makes Quicka Different

Evidence-Informed Treatment Plans

After a consultation, Quicka auto-drafts personalised treatment plans pulling in evidence-based recommendations. A physio's knee assessment auto-generates an exercise program based on latest clinical evidence — ready in seconds, not hours.

Communication Coaching

Private feedback on consultation style — highlighting interruption patterns, jargon usage, and empathy opportunities. Like having a senior mentor reviewing every session, without the scheduling headaches.

Integrated Document Workflow

Auto-generates referral letters, insurance reports, NDIS/Medicare forms pre-filled from the conversation. Transcribe → Draft → Format → Send — all in one seamless flow.

Personalised to Each Clinician

Upload your own templates, define your writing style, set your preferred note schema. Every clinician gets a "custom AI" tuned to them — the first draft already sounds like you. Learns and improves over time from corrections.

On-Demand Clinical Mentoring

"Have I considered all possible causes for these symptoms?" — Ask Quicka and get context-aware answers drawing from trusted clinical knowledge bases. A knowledgeable colleague available 24/7.

"From the very first time using AI, I had eye contact and direct conversation; it was great."— Patient feedback from Healthia AI scribe study

Competitive Landscape

They Transcribe. We Transform.

Every competitor stops at the transcript. Quicka uses it as the starting point — extracting clinical and business intelligence that improves outcomes.

Where Competitors Stop

Quicka's Intelligence Layer

Every consultation generates a rich transcript. Competitors discard this data after notes. We mine it for insights that compound over time.

- In-Session Guidance — Real-time clinical reasoning support during the consultation

- Communication Coaching — Post-session analysis of rapport, empathy, and patient engagement

- Evidence-Based Treatment Plans — AI-generated plans grounded in session data and clinical evidence

- Outcome Tracking — Higher treatment plan compliance → more rebookings → measurable revenue uplift

- Peer Learning Networks — De-identified case discussions that break clinical isolation

Market Investment Validates Demand

Investment in AI clinical documentation nearly doubled from US$390M (2023) → US$800M (2024). All of it funding scribe-only tools. Quicka captures the next wave — intelligence, not just transcription.

Business Model

Tiered SaaS — Scalable Revenue

| Tier | Features | Pricing |

|---|---|---|

| Scribe | AI transcription, structured notes, referral letters | A$179/mo |

| Professional | + AI Mentor, communication coaching, treatment plans | A$249/mo |

| Enterprise | + Peer networks, multi-site analytics, CPD, SSO | Custom |

Growth Drivers

- Land & Expand: 40–60% upgrade Scribe → Professional within 18 months

- Viral Loops: 95% recommendation rate + group features create organic growth

- Net Revenue Retention: Tier upgrades + seat expansion target >120% NRR

| Subscribers | MRR | ARR | AU Market |

|---|---|---|---|

| 100 | A$19.9K | A$239K | 0.03% |

| 500 | A$99.5K | A$1.19M | 0.14% |

| 1,000 | A$199K | A$2.39M | 0.29% |

| 2,500 | A$498K | A$5.97M | 0.71% |

| 5,000 | A$995K | A$11.9M | 1.43% |

AU Market = % of 350K+ AU healthcare professionals (source: AHPRA 2024/25: 148K doctors + 200K+ allied health). Global TAM: 10M+.

Blended ARPU ~A$199/mo (50% Scribe · 35% Professional · 15% Enterprise)

Forward-looking projections for illustrative purposes. Actual results may vary.

Unit Economics

Margins That Scale

SaaS-grade unit economics with AI costs that amortise as subscriber base grows — reaching 85%+ gross margin at scale.

Per-User Cost Breakdown

| Subscribers | Revenue | COGS | Gross Profit | Margin |

|---|---|---|---|---|

| 100 | A$239K | A$55K | A$184K | 77% |

| 500 | A$1.19M | A$228K | A$962K | 81% |

| 1,000 | A$2.39M | A$432K | A$1.96M | 82% |

| 2,500 | A$5.97M | A$870K | A$5.10M | 85% |

| 5,000 | A$11.9M | A$1.5M | A$10.4M | 87% |

"AI API costs per user decrease with volume commitments — our margins improve with every subscriber added."— SaaS-grade economics with strong operating leverage

Illustrative unit economics. COGS decreases with volume pricing from AI providers.

Enterprise Value Proposition

Enterprise Case for Quicka

Clinic networks that invest in Quicka unlock measurable ROI across every dimension of practice operations.

9.5h Reclaimed Weekly

Documentation drops from 13.5h to ~4h/week per clinician — freeing 9.5 hours for patient-facing time or personal wellbeing.

A$65K Revenue Recovery

Each clinician recovers ~A$65,000/year in previously lost billable time. A 10-clinician clinic unlocks A$650K annually.

Staff Retention

80% of clinicians cite paperwork as a key burnout driver. Quicka directly addresses the #1 attrition factor — protecting your talent pipeline.

Additional Enterprise Benefits

- Reduced Clinical Risk — AI-guided differentials + full audit trail reduce adverse events and strengthen compliance

- Clinical Development at Scale — Most clinics can't afford structured supervision; AI mentor fills the gap at a fraction of the cost

- Plan Adherence Uplift — Evidence-based treatment plans increase patient compliance, driving more rebookings and revenue

- Reception Efficiency — Smart matching automates appointment linking, saving ~30 min/day per front-desk staff

Enterprise ROI Example

Higher plan adherence → ~3 extra rebookings/wk/clinician × A$90

Technology & Security

Healthcare-Grade Security at Every Layer

Patient privacy is non-negotiable. Quicka is built compliance-first with Australian data sovereignty and global standards.

Encryption & Compliance

AES-256 at rest, TLS in transit. All subprocessors sign BAAs and are HIPAA compliant and GDPR compliant. Privacy Act 1988 aligned.

Data Storage & Sovereignty

All patient data stored on Australian servers. Zero audio and data retention by transcription and AI providers — nothing persists outside your environment.

Zero-Retention AI Pipeline

All AI subprocessors operate under zero data retention agreements. No patient audio or transcript data is stored by external services after processing.

Audit Trail & Transparency

Every AI action is logged and traceable. Clinician remains the ultimate gatekeeper — all outputs are reviewed before finalisation.

Founder & Go-to-Market

Built By Clinicians — Australia First, Then Global

Quicka Health was born in a real clinic. Our founder ran a busy allied health practice — personally experiencing late-night note writing and spending more time on paperwork than patients. Every feature is shaped by firsthand clinical experience.

Domain Expertise + Fast Feedback

Our founder continues to practice — acting as our own beta tester. Issues are caught in days, not months. "Built by one of us" lowers the trial barrier in a conservative sector.

Strategic Launch Partner

Multi-site validation with Healthia's 400+ clinic network across Australia and New Zealand accelerates time-to-traction from years to months — spanning physiotherapy, occupational therapy, podiatry, hand therapy, and more.

Additional Adoption Channels

- Direct outreach: clinic visits, conference demos, lunch-and-learns

- Professional bodies: APA, OT Australia — CPD webinars & endorsements

- University partnerships: pre-service training for new graduates

- PMS integrations: Cliniko & Nookal live, expanding to Best Practice

Scribe Launch

GA launch anchored by Healthia enterprise rollout plus direct outreach to private allied health & GP clinics. Convert beta users. Address the 87% AI literacy gap with low-risk documentation.

Enterprise & Treatment Plans

2–3 enterprise pilot contracts with clinic networks. Expand treatment plan automation & NDIS reporting. Begin NZ expansion.

Network Effects & International

Launch peer learning networks. Enter UK market via strategic partnerships. Drive viral growth through group features.

Market Tailwinds

- ADHA Allied Health Digital Uplift — A$2M+ govt investment

- My Health Record deadline July 2026 driving adoption

- Federal A$228.7M digital health budget (2025-26)

Strategic Fit

Healthia × Quicka Health

A partnership where both sides bring something the other can't build alone — creating a compound advantage that accelerates growth for both.

| Strategic Alignment | How It Works |

|---|---|

| Distribution | Healthia's 400+ clinics across AU & NZ provide immediate deployment scale across physiotherapy, OT, podiatry and beyond — years of outreach compressed into months |

| Product Development | Real-world clinician feedback from multi-discipline usage drives Quicka's roadmap — features built for real workflows, not assumptions |

| Revenue | Enterprise licensing creates predictable ARR for Quicka; Quicka recovers A$65K/clinician/year in billable time for Healthia's network |

| Market Position | Healthia leads allied health innovation; Quicka provides the AI technology layer that differentiates their clinics from competitors |

| Credibility Signal | Healthia's backing tells every other clinic and investor that Quicka is enterprise-validated — accelerating adoption and increasing the value of Healthia's own equity position |

Preferential Pricing

30–50% discounted rates locked in for the life of the partnership — representing A$50K–100K+ in annual savings across the network.

Roadmap Influence

Direct influence over development priorities. Clinical workflows, specialty requirements, and integration needs are prioritised in the pipeline.

Early Access

Beta access to new features 3–6 months before general release — Healthia's clinicians lead the adoption curve and gain competitive edge.

The Credibility Flywheel

Healthia's name on the cap table → other clinics trust the product → faster adoption → more revenue → higher valuation → Healthia's equity is worth more

The Investment

Seed Round: A$500K – A$1M

Capital-efficient funding to reach product-market fit and revenue traction — with a clear pathway to continued growth beyond this round.

Use of Funds

Funding Pathway

Strategic partnership investment. Enterprise rollout, product-market fit.

Equity crowdfunding (Birchal) — clinicians investing in their own tools. Non-dilutive grants (ANDHealth+, MRFF).

Institutional VC backed by traction data: 1,000+ users, A$2M+ ARR, published case study.

18-Month Milestones

- Healthia enterprise deployment across clinic network

- Launch v1.0 commercially → 1,000+ paid clinician users

- Secure 2–3 additional enterprise pilot contracts

- Expand PMS/EHR integration coverage

- Publish referenceable case study with quantified outcomes

- SOC2 / ISO 27001 audit complete or in progress

- Equity crowdfunding campaign prepared

Beyond Efficiency to Intelligence.

Beyond Automation to Augmentation.

Quicka Health

Strategic Partnership & Seed Investment · Australian Allied Health AI Transformation

This presentation contains forward-looking statements and market analysis based on available research data.